More than 40,000 people had their mortgage applications approved in April – the highest number since February 2017, according to trade association UK Finance.

More than 40,000 people had their mortgage applications approved in April – the highest number since February 2017, according to trade association UK Finance.

This comes as the Intermediary Mortgage Lenders Association (IMLA) reveals 89% of mortgage applications were approved between January and March 2019 – a three-year high.

It’s no secret that the UK’s housing market has seen turbulence in recent months, and some are interpreting this news as a sign of an uplift in the market as a whole. So, if you’re in the process of applying for a mortgage of your own, find out how you can join the tens of thousands who have already been approved.

Remortgaging and mortgages for homebuyers both on the up

UK Finance says a total of 42,989 mortgage applications for house purchases were approved in April 2019, up 6% from March this year and 11.5% from April 2018, when seasonally adjusted.

Remortgaging approvals are also doing well: more than 31,000 applications were approved last month – the most since November 2017.

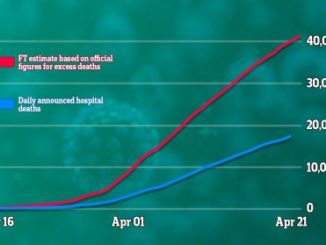

Mortgage approvals since January 2018

Approvals have been high for both conventional and specialist mortgage products. The IMLA says specialist mortgages have a slightly higher approval rate at 91%.

The specialist mortgage market has seen a large number of products appearing in recent months, with retirement interest-only mortgages, known as RIOs, seeing particular growth.

Some borrowers, such as those who are retired or have bad credit, find these kinds of products particularly suited to their needs.

Mortgage applications: how to get yours approved

If you’re hoping to join the thousands of borrowers who were approved for mortgages last month, there are a number of things you can do to boost your chances.

Maximise your credit rating

In most cases, it’s fair to say that having a good credit score means you’re more likely to get a mortgage.

You can check your credit rating for free online with any of the three main credit reference agencies – Equifax, Experian, and Transunion (formerly Callcredit).

However, for a detailed breakdown of why your score is what it is, you’ll need to sign up to a subscription service. It’s worth checking your credit report carefully to find any mistakes, as correcting them could boost your score. (If your credit score is still poor, you could consider a bad credit mortgage.)

Read our investigation into credit scoring to find out more about how credit scores work, and see our guide for tips on how to improve your credit score.

Register to vote

You might think that registering on the electoral roll is all about democracy, but it can also help you get a mortgage.

Most mortgage lenders will use the electoral roll to confirm your identity and current address. You may be refused for a mortgage entirely by some lenders if you are not registered.

If you haven’t put your name down, head to Gov.uk and sign up now. All you need is your National Insurance number and, if you’re a British citizen living abroad, your passport details.

Save the biggest deposit you can

A larger deposit won’t just help you get a mortgage – it can help you get a better interest rate, too.

Unless you’re taking out a guarantor mortgage, you’ll need a deposit of at least 5% to take out a home loan. But if you save more, you’ll be able to borrow at a lower loan-to-value ratio (LTV), which usually means paying a lower interest rate.

Find out more with our guide to how much deposit you need for a mortgage.

Clear current debts

Reducing or paying off any debts you currently have can boost your chances of mortgage approval for a very simple reason: if you don’t have to pay back other loans, you’ll have more money each month to pay your mortgage.

If you can, clear your credit card bills and personal loans, and move out of your overdraft.

- For more tips and tricks for your application, see our guide to improving your mortgage chances and our roundup of 10 ways to boost your mortgage chances in 2019.

Get expert advice on your mortgage application

An independent mortgage broker can vastly improve your chances of getting a mortgage. They can find the best mortgage deals that you qualify for, and give you more tailored tips on how to get approved.

–

Credit: Which.co.uk